Dresner Advisory Services publishes an annual study on Mobile Business Intelligence vendors, the latest in October 2011. It focuses on the mobile capabilities of BI platform vendors similar to those in the Gartner Magic Quadrant for Business Intelligence we recently looked at.

The ~50 page document has a good executive summary and provides insight from industry surveys and changes between 2010 and 2011. In terms of data visualizations, it generally does a poor job of conveying the study findings. There is an abundance of pie charts and stacked bar charts with often very confusing color codes. For example, consider this chart on BI vendor mobile platform priority:

Rank information shouldn’t be conveyed by color (better by vertical position). It is very confusing to see which platforms gained or lost in the ranking. A data visualization should first and foremost make it easy to spot patterns and thus provide insight. Not every dataset makes for a good Excel bar chart.

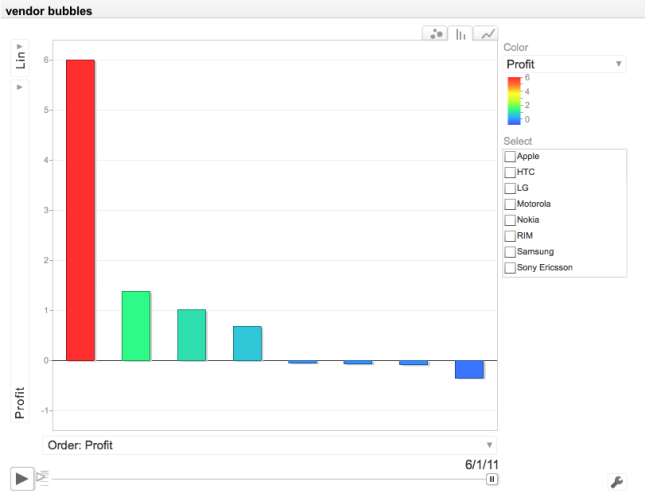

All that said, I found one very useful chart which shows all vendor Mobile BI capabilities at a glance:

Regarding the vendor scoring, from the study:

Using the data that was provided by twenty-four different BI vendors, we constructed a model which scores them based on mobile platform support, platform integration and numbers of supported BI features (Figure 33).

Please carefully review the detailed vendor and product profiles on pages 47 – 52 and to consider both dimensions (i.e., platform and features) independent of each other.

It should be noted that this model reflects only two dimensions of a BI vendor’s product capability and is not intended to indicate “market leadership” only a convergence of capabilities for Mobile BI. Readers are encouraged to use other tools to understand the many other dimensions of vendor capability, such as our own Wisdom of Crowds Business Intelligence Market Study ®.

The full report can be downloaded from the Yellowfin website here.