SmartMoney has an interactive visual tool on their website called “Map of the Market”. It is an application of the TreeMap concept developed by Ben Shneiderman which I have blogged about before here.

The map lets you watch more than 500 stocks at once, with data updated every 15 minutes. Each colored rectangle in the map represents an individual company. The rectangle’s size reflects the company’s market cap and the color shows price performance. (Green means the stock price is up; red means it’s down. Dark colors are neutral). Move the mouse over a company rectangle and a little panel will pop up with more information.

For example, the above map shows the 26 week performance with the Top 5 Losers highlighted (hovered over RIMM). More information from the corresponding Map Instructions page.

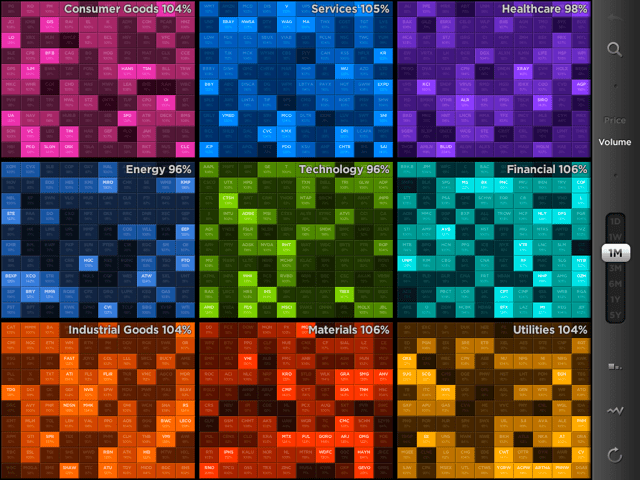

This map is also quite similar in concept to the StockTouch iPad app which I covered here. StockTouch displays 900 companies, grouped into 9 sectors. The above Map of the Market is a free service, with an available upgrade to one showing 1000 companies for a subscription fee. While interesting in its own right, however, this is not about the business model of how to monetize the use of such information.

It might be interesting to put together a time-lapse video showing this map for every close of business day throughout one year. Not only would one see the up and down movement by color, but also the gradual shifts in the cumulative size of various sectors due to the area in the tree map.

Another fascinating set of tree map uses is on display at the Gallery of the Hive Group website. Their interactive tree map product HoneyComb has been used in many different industries. The Gallery shows many examples, ranging from sales performance to manufacturing / quality applications to public interest uses such as browsing Olympic Games results or data on Earthquakes. See the following example screenshot (click to interact on the Hive Group website):

While you won’t get the full benefit of seeing the details of all 540 items in one view, you can filter using the panel controls on the right or change the grouping and size and color attributes. This shows for example that the most powerful earthquakes are generally not the most deadly ones and vice versa.

Interacting with these sample tree maps again drives home the fundamental notion that interactive visualizations lead to quicker grasp and better understanding of data sets. This is similar to how walking around and seeing an object from different perspectives gives you a better idea of it’s 3-D structure than seeing it just in one 2-D picture. With multiple ways of interacting it feels almost as if you’re walking inside the data set to see it from multiple angles and perspectives. You have to do it yourself to appreciate the difference it makes.

Lastly, a good article on some of the pitfalls of tree map design with lots of links to good/bad examples comes from the folks at Juice Analytics in their Blog post titled “10 lessons in Treemap Design“.